how to lower property taxes in ohio

Twyford will help. Located in central Ohio Stark county has property taxes far lower than most of Ohios other urban counties.

Brecksville Finance Property Taxes

If you own a property in Ohio and this rate concerns you there is a way to lower your property taxes.

. Supreme Court sided with Ohio Attorney General Dave Yost on Tuesday in overturning lower court decisions compelling the warden of Chillicothe Correctional Institution to take a death-row inmate to a Columbus hospital for a brain scan. Claim the homestead exemption if you are eligible. Your local tax collectors office sends you your property tax bill which is based on this assessment.

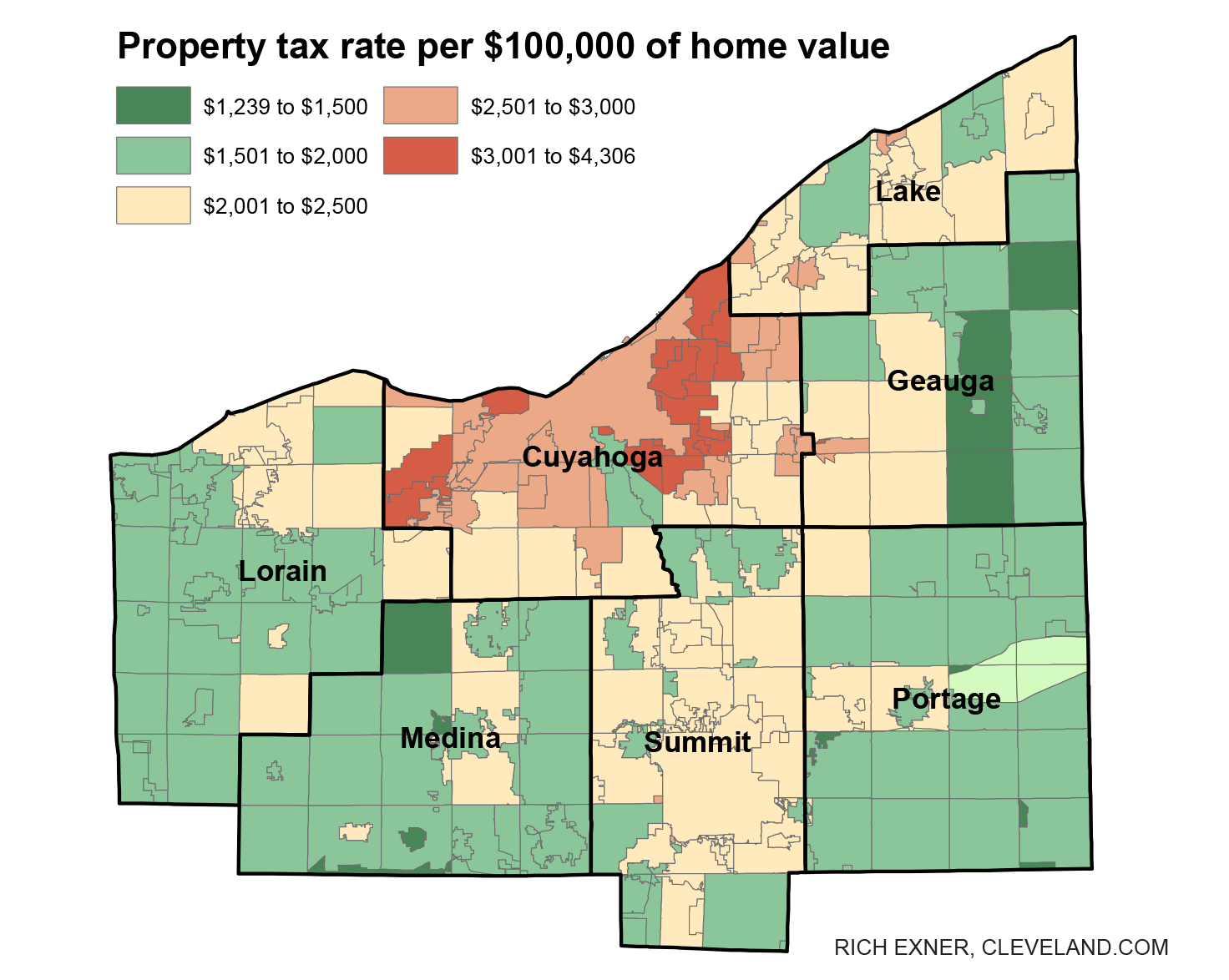

Located in central ohio stark county has property taxes far lower than most of ohios other urban counties. Property Tax Real Property. Property tax rates in Ohio are expressed as millage rates.

The exemption offers homeowners who are disabled or over 65 years old a reduction of 25000 from the market. Once the complaint is received the BOR will take two actions. How can I lower my property taxes in Ohio.

Town Tax Rate x Assessed Value100. Ohio Property Tax ExemptionFrom A to Z. School districts generally receive between 65 percent to 70 percent of property taxes collected meaning that they.

A homestead exemption is available for qualifying homeowners see Credits. First if the owner is seeking a decrease in property value of more than 50000 the BOR will notify the local school district. In fact the countys average effective property tax rate is just 142.

In order to come up with your tax bill your tax office multiplies the tax rate by. Right now property values for 2017 are the focus of attention. Apply for the current agricultural use value program if you have real property devoted to commercial.

Taxes may be reduced by an additional 25 percent if the home is owner-occupied. Come cannot exceed the amount set by law. This way if the Town Tax Rate is 3 per 100 and the Assessed Value is 400000 then the property tax will be 12000 a.

Beginning tax year 2020 for real property and tax year 2021 for manufactured homes total income is definedas modifiedadjusted gross income which is comprised of Ohio adjusted gross income plus any busi-ness income deducted on Schedule A line 11 of your Ohio IT 1040. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Lets say that Mike and Wendy appeal the 200000 taxable value of their home.

Up to 25 cash back If they can reduce the taxable value of their home their property tax bill will be lower. The exact time frame to begin filing appeals varies but all counties in Ohio must accept appeals through March for the tax bills due that. Each year the department calculates effective tax rates based on tax reduction factors that eliminate the effect of a change in the valuation of existing real property on certain.

The tax is determined by applying the effective tax rate to the assessed value and applying a 10 percent rollback. One mill is equal to 1 of tax for every 1000 in assessed value. The biggest step you can take though is to launch an appeal to have your assessment reappraisedand hopefully reduced.

Value assessments of homes are public. In Ohio property owners pay taxes for periods of time that have already passed so you may hear that owners are paying taxes one year in arrears. Ohio Property Tax Rates.

Between 20 and 40 of homeowners in Ohio who appeal their property tax assessment receive a reduced valuation. Given this Mike and Wendy owe only 1500 in property tax on their Ohio home. How to Appeal PropertyTaxes in Ohio.

The DTE Form 1 Complaint Against the Valuation of Real Property gives the Board of Revision the complaining partys opinion of a property s estimated value for the year the tax is due. How To Lower Property Taxes. The best way to do so is to check whether you qualify for a property tax exemption.

Obtain an application from the Ohio. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. With a property tax rate of 148 Ohio holds 13th place among states with the highest property tax rates.

The issue of taxes cannot be addressed. The exemption offers homeowners who are disabled or over 65 years old a reduction of 25000 from the market value of their principal residence for property tax purposes. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you win it.

Property Tax Real Property. As detailed by the ohio department of taxation the homestead exemption allows qualifying individuals to remove a maximum of 25000. How to Lower Your Property Taxes.

The ruling in Shoop v. Lower Your Ohio Property Tax Your rental property value has likely declined in. Property taxes are calculated as.

18 hours agoCOLUMBUS The US. With housing prices going up this means property values and by extension taxes go up as well. In order to lower your current property tax.

Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. This is awarded as a rebate or tax credit that is intended to cover a portion of your property tax bill. The appeals board agrees and reduces that value to 150000.

How can I lower my property taxes. For example a 100000 home would be taxed as if it were a 75000 home. Form DTE 105A is available on the Ohio Department of Taxation website.

Elderly and disabled homeowners who qualify for an Ohio homestead exemption are exempt from property taxes on their homes by using the exemption to reduce their market value by 25000 in tax years. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Hiogov 105 Tax reduction factors.

In Ohio property owners pay taxes for periods of time that have already passed so you may hear that owners are paying taxes one year in arrears. How to Lower Your Property Taxes. We always look back in time when it comes to paying real estate taxes and discussing property values.

For example if the AV of your property is 30000 and your tax rate is 10 you would pay 30000 x 10 3000 in property taxes. The appeal process is complex and demands time and effort as well as a lot of documentation. Right now property values for 2017 are the focus of attention.

Distributions Real Property Tax Rollbacks Department Of Taxation

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Tax Help Cuyahoga County Department Of Consumer Affairs

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

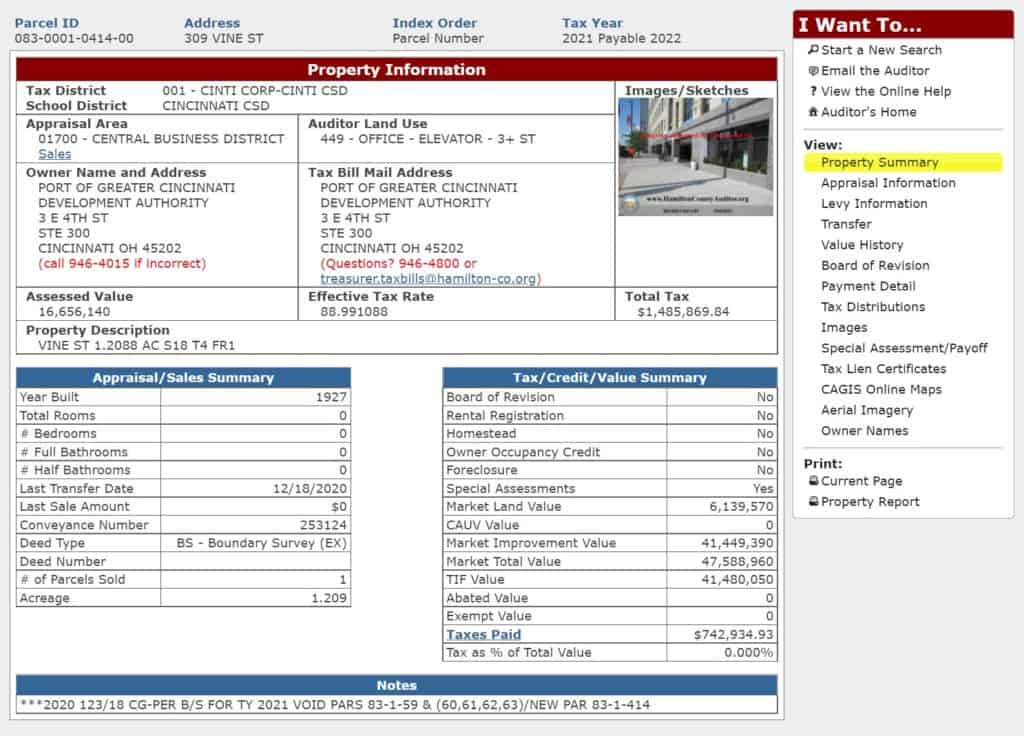

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Real Property Tax Homestead Means Testing Department Of Taxation

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Pay Property Taxes Online County Of Columbiana Papergov

Ohio Property Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Brecksville Finance Property Taxes

Ohio Property Tax Calculator Smartasset

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com